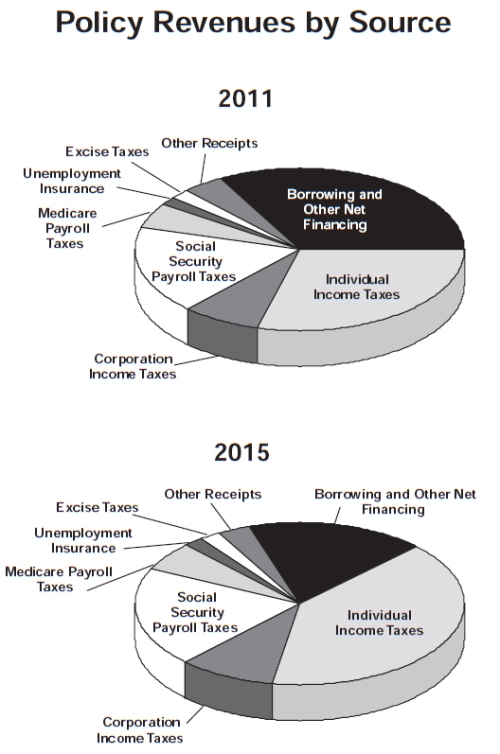

While U.S. Citizens await a clear understanding of what was cut from the Federal Government’s 2011 Fiscal Year budget, let’s take a look at the sources that fuel revenue for the Federal Government’s budget.

According to the 2011 FY Federal Government budget, here’s the 2011 outlook on the sources of revenue for this budget and a look at where the U.S. is heading in 2015.

As you can see, there is a fairly significant increase predicted during 2011 – 2015 on revenue generated from individual income taxes; corporate income taxes see a slight increase during this same time period. Borrowing and Other New Financing is predicted to decrease from 2011 – 2015. Social Security Payroll taxes, Medicare payroll taxes, Unemployment Insurance, Excise Taxes (taxes on goods often included in the price of the good, i.e. gasoline) and Other Receipts stay steady during this time period.

This pie charts above separate Individual and Corporation Income taxes into two unique revenue category. Corporations in the U.S. are legally classified as citizens, giving them all the rights, privileges and power of an individual – except when it comes to taxes and funding the Federal Government’s budget. Note: corporations were recently allowed to fund politicians’ campaigns – this money is primarily used for campaign advertising and marketing, not policies or other federal initiatives. U.S. Corporations get the best of both worlds – Corporations have the ability to hand select politicians through strategic campaign financing thus determining how the U.S.’s Federal Government’s Budget is spent and U.S. Corporations have less financial responsibility to fund the U.S.’s Federal Government’s Budget via Corporate tax incentives. Capitalism, not socialism, is the guiding principle for the U.S. political system and Federal Government. U.S. individual taxpayers have the greatest financial responsibility to fund the Federal Government’s budget and the least access to the resources (finances and media) to compete against Corporation Taxpayers when selecting political representatives.

When U.S. citizens pay taxes by April 15, 2011, if they were to receive a receipt from the IRS letting them know where the percentage of their hard earned paycheck went, here’s what that receipt would look like:

Sources: The Atlantic. Where Do Your Tax Dollars Go? A Long Story in 5 Quick Graphs, by Derek Thompson; Office of Management and Budget, http://www.budget.gov. Budget of the U.S. Government Fiscal Year 2011.